#9 What makes Jio different?

Read Time: 17 minutes

Author's Note

Huge thanks to Harish Udayakumar for patiently explaining how telecom technology works to me. I ate his head for 2 hours straight but he was very nice about it. He's a treasure-house of knowledge on the telecom & microprocessor sectors.

I'll be honest. The original version of this piece was about why American tech companies were interested in Indian telecom players. I had started writing this when the news doing the rounds was Facebook & Microsoft are investing in Jio, Google was in talks with Vodafone-Idea, and Amazon was interested in Airtel.

Fast forward to the present and all of Facebook, Microsoft, Google and Amazon have either invested or are in talks to invest in Jio/Reliance (I say Reliance here because Amazon is in talks to invest in the retail arm of Reliance and not Jio exactly). In addition to this, we all know Jio has gone on a fundraising spree raising more than $20B in less than 3 months.

Why are all these companies and investors lining up in front of Jio?

The most obvious answer is the promise of the Indian market. India now has more than a billion mobile subscribers. But more importantly, the number of internet users has been exploding. From just 22% internet penetration in 2015 (internet users divided by total population), India has seen it almost double to 41% in 2019 (463M users). The country is expected to cross 800M internet users in 2021. Taking into account both the high growth rate in internet users and the pending growth potential (at 800M users, India will be at only 60% penetration), we can safely assume that India will be adding the largest number of new internet users in the world in the next 3-5 years.

This obviously makes the Indian market very attractive to global tech companies and investors. But it only partly explains the interest in Jio. Because then, we would have seen investors lining up in front of Airtel, Vodafone Idea & BSNL too. Okay sorry, not BSNL...lol.

So what makes Jio different from the other telecom players?

I believe the answer lies in 2 advantages Jio has.

The tech advantage

The business advantage

1. The Tech Advantage

The architecture of Jio's mobile network technology is quite different from that of its competitors which gives it certain advantages. To understand it better, we have to dig into the basics of networking technology and its evolution

The 2G era (2002-2011)

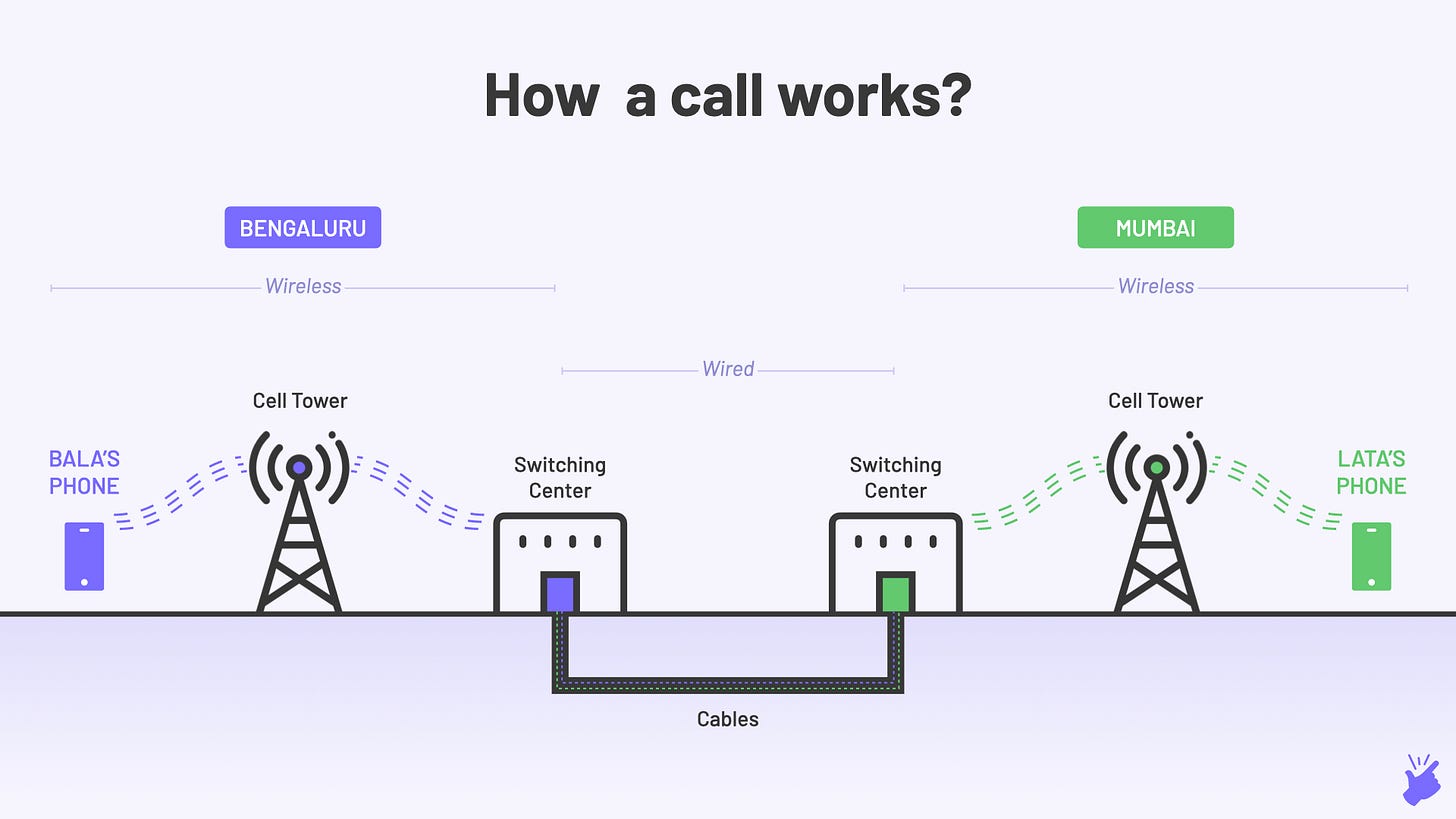

How did calls work in the 2G era? What was the technology used? Let's view this through an example. Re-introducing Bala. Remember Venture Capitalist Bala from our previous post? He is in Bengaluru and wants to make a call to his friend Lata in Mumbai.

When Bala presses the call button on his phone app, a digital signal is sent from the antenna on his mobile phone to the nearest Cell Tower (also called Base Station). From there, the signal is transmitted to a Switching Center (imagine a small office building with lots of telephone wires).

This Switching Center is not a standalone office. It is actually part of a network of switching centers spread across the world. This network is called the Public Switched Telephone Network (PSTN). There's another option called the Integrated Services Digital Network (ISDN). The call you make from your mobile phone could use either of these networks depending on your telecom provider (basically whose SIM card you use).

So Bala's Switching Center contacts other centers in the PSTN/ISDN network to identify the center closest to Lata. Once Lata's Switching Center is identified and notified, it sends a signal to the Cell Tower nearest to Lata, which then transmits it to Lata's phone. It's at that point that Lata's phone rings. If Lata answers her phone, a connection is set up between Bala's and Lata's Switching Centers.

What do I mean when I say 'a connection is set up'? As we saw earlier, the Switching Center is part of a larger worldwide network (PSTN/ISDN). These centers are connected with each other via cable wires buried under land and oceans. One of these cables that runs between the Bala's and Lata's switching centers is reserved for the duration of the call. Because whatever Bala speaks is transmitted over this cable (in the form of electromagnetic waves) to Lata and vice-versa.

Now, Lata's Switching Center is situated 100s of kilometres away from Bala's Switching Center meaning there might not be a direct cable between them. So how do Bala's words reach Lata's switching center? The message actually gets transmitted in relay style, going via other centers in-between (Eg: Bengaluru → Tumkur → Hubli → Satara → Pune → Mumbai). For every call made, a different path could be used depending on which cables are available.

You could call this path a 'circuit' since it is essentially a closed path over which information flows from point A (Bala) to point B (Lata). And this process where the switching centers keep changing the paths/circuits for every call is called circuit switching.

The interesting point is the circuit switching network (PSTN/ISDN) actually pre-dates the 2G era and has existed for over a century. It was the network behind our landline telephones as well. In the era of landlines, there was a wire from your home phone to the Switching Center (carried over those scary-looking telephone poles). In the era of mobile phones, this connection between your home phone and the Switching Center became wireless while the connection between switching centers remained wired (so mobile communication is not entirely wireless!). This wireless technology that was built over the circuit switching network was called the Global System for Mobile Communications (GSM).

There was a competing tech that was built later called Code Division Multiple Access (CDMA). The difference between the two is too technical to explain here and it would suffice to say both did the same job but differently. GSM, along with CDMA, ushered in the 2G era.

But they had one major problem. Both networks worked only for voice calls. Mobile data (your internet, basically) could not be transmitted on this network. To tackle this, telecom operators then built another network parallel to the circuit switching network which transmitted data.

This 'network for data' works similarly to the 'network for voice' but only up to the Cell Tower. So if Bala is messaging "Hello" to Lata over WhatsApp, this information is transmitted over from the mobile antenna to the Cell Tower exactly like we saw earlier. From then on, the process is different. From the tower, the data is transmitted to a router (just imagine a scary-looking box). This router, like a Switching Center, is part of a network of routers. The router closest to Bala figures out the router closest to Lata. Again, routers that are far off might not be directly connected. So the information from Bala's router is routed (hence the name "router") via various other routers in between till it reaches Lata's router. From there, the information is transmitted to Lata's phone via the cell tower. And Lata's phone buzzes with a notification "Message from Bala".

However, there's one key difference between how the network of routers (the data network) works vs how PSTN/ISDN works. Like we saw earlier, PSTN/ISDN uses circuit switching to set up a connection and transmit voice. But the data network uses a process called packet switching. The message "Hello" that Bala is sending across is broken into pieces called 'packets'. These packets are sent from router to router till they reach the destination router. But they don't need to travel together. Each packet takes its own route to the destination router depending on the traffic on a particular path. Each packet has two bits of information - the destination id and a sequencing id. Destination id ensures all the packets reach the same and correct destination, ie, Lata's phone. Sequencing id ensures the packets are rearranged to the right order, ie "Hello", not "Ohlel"

Because voice calls use circuit switching, which involves reserving a cable between 2 switching centers, you pay based on the amount of time you reserve the cable for (₹X/minute). Because mobile data uses packet switching, which involves sending packets across routers, you pay based on quantity of packets send (₹X/GB)

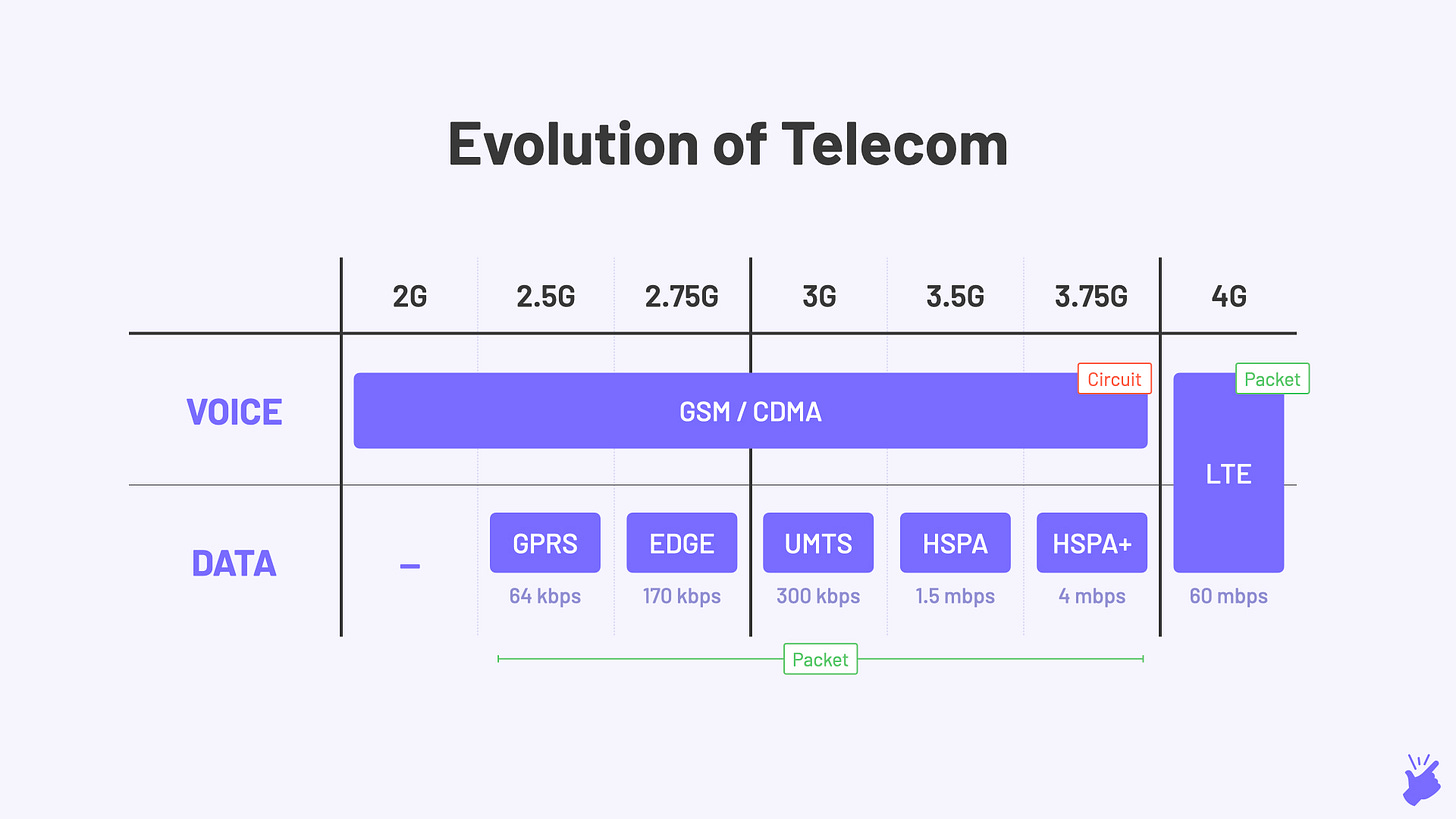

The first version of this 'network for data' was called General Packet Radio Service (GPRS). GPRS enabled data speeds of up to 64 kbps. And few people called GSM (voice) + GPRS (data) combination 2.5G. Someone then developed a faster data network called Enhanced Data Rates for GSM Evolution (EDGE). EDGE + GSM was referred to as 2.75G and achieved data speeds of 170 kbps.

Do you remember seeing a G or a E near those network strength bars at the top of your old phones? Those stood for GPRS and EDGE respectively.

The 3G era (2011-16)

There was no major overhaul of the network architecture in 3G. The voice network (PSTN/ISDN) remained the same. What evolved was the data network. A new data network called the Universal Mobile Telecommunication Service (UMTS) averaging download speeds of 300 kbps was built for the GSM-based phones. In parallel, the Evolution-Data Optimized (EVDO) network was developed for the CDMA based phones.

3G data networks were later replaced by a new 3.5G tech called the High Speed Packet Access (HSPA), averaging download speeds of 1.5 mbps. This too was soon replaced by HSPA+ (3.75G tech) that achieved speeds of 4 mbps. Again, you would have seen these on your phone as 'H' or 'H+' near those network strength bars.

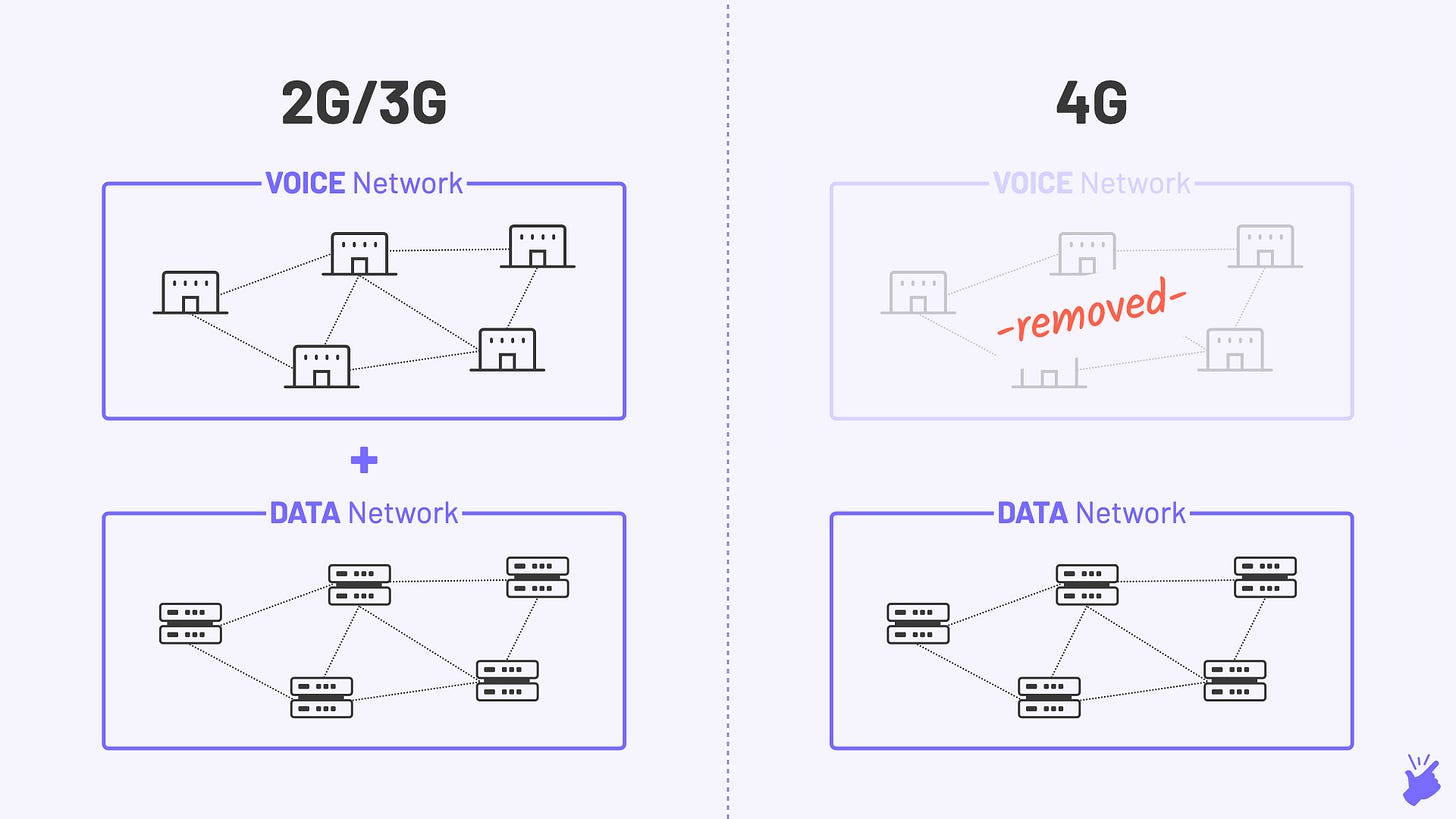

3G was essentially just faster 2G. The voice network was still a legacy one and data network was just marginally better. Telecom players had to operate both networks to provide a complete service. We were heading to a future that involved streaming heavy HD videos, office work being completely online, online gaming, etc. Data speeds required were significantly higher and to achieve that, network architecture had to be completely re-thought.

Enter 4G (2016-)

It was in 4G that the network architecture was reimagined from ground-up. If you look at 2G/3G architecture, voice network was the core and data was an afterthought. In 4G architecture, data took centre place. The voice network was removed making way for a single evolved network built just for data (the one with routers). This was called Long Term Evolution (LTE) and enabled download speeds of 12-15 mbps. Over time, it has now reached speeds of 60 mbps.

The beauty of 4G is that voice is also treated as data hence removing the need for a voice network. Basically, if Bala says "Hello" on the phone, the voice is broken into packets and transmitted over routers as it happens with WhatsApp messages. Since voice is carried over the data network, ie the LTE network, it is called voice over LTE (VoLTE). This works very differently from the PSTN/ISDN networks in 2G/3G and was the reason for the huge hullabaloo during its launch.

In 2G & 3G, because 2 different networks are used for voice and data, you cannot use one while using the other. When you used to browse on your laptop using a mobile phone hotspot, did you ever notice your internet stop working when you got a call? Its was because of this. Pretty uncommon now since most of us have shifted to 4G where both voice and data use the same network and can work simultaneously.

I know you must be thinking "Hey, all this is interesting (or boring) but I came here for Jio". We're almost there. Here's a quick summary before jumping into Jio.

So how does Jio have an advantage?

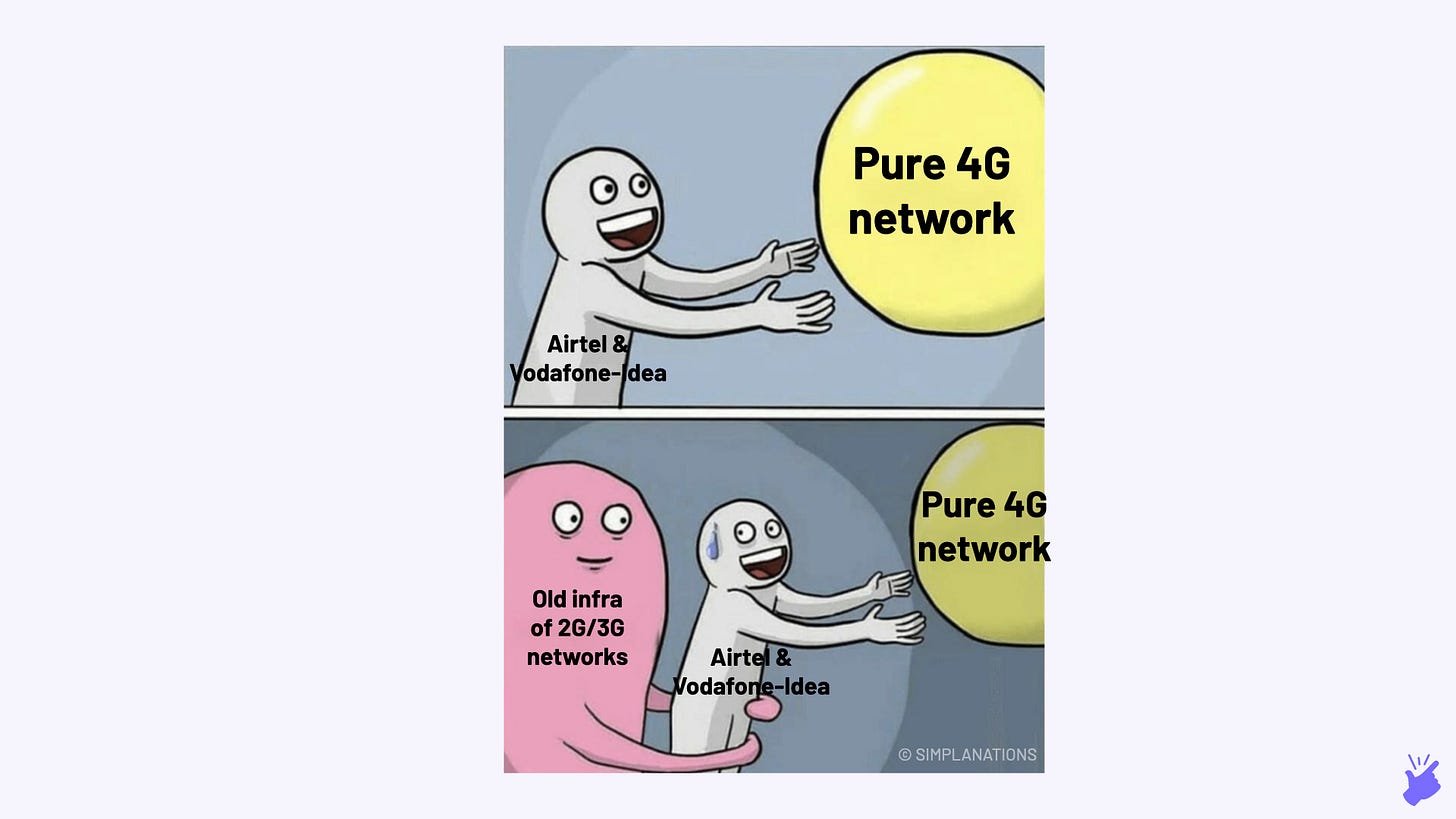

The advantage that Jio has over Airtel and Vodafone-Idea is that it is a purely 4G/LTE network. It was important to understand the weight of this sentence and that is why I spent some time explaining the technologies above.

Jio has to maintain only one network (the one for data) while others have to run one network each for voice and data. Equipment needed is much lower for Jio hence lowering their cost. Also, the voice networks that others have to run are old (decades-old tech!), energy inefficient, and occupy a larger real estate footprint. This really shoots up their cost, a cost that Jio entirely bypasses. Nokia, which now focuses on building and managing these networks for telecom companies estimates cost savings of 50%+ on shifting from a 2G/3G architecture to a data-only 4G architecture.

Even though Airtel & Vodafone-Idea have launched 4G services, they still operate their 2G/3G networks because they have a significant subscriber base still using 2G/3G sim cards (you need a new 4G enabled sim card if you want to use the 4G network). 56% of the overall mobile subscribers in India are still on 2G/3G. And since Jio offers only 4G, all these 2G/3G subscribers are split between Airtel, Vodafone-Idea and BSNL. In fact, 3/4ths of Vodafone-Idea's subscriber base was still on 2G/3G towards the end of 2019.

Airtel & Vodafone-Idea even use the voice network of 2G as a fallback option when VoLTE (calls over the data network) don't work. Airtel has confirmed that while they are trying to phase out 3G, they will continue offering 2G (the voice network) along with 4G. So Airtel & Vodafone-Idea have a higher cost structure than Jio despite offering 4G.

There's another advantage that pure 4G play offers Jio. Both 2G & 3G use the PSTN/ISDN network for their voice calls. Like we discussed earlier, these networks use circuit switching which, if you remember, essentially involves a cable between 2 switching centers being reserved entirely for a call between two phones. If every phone call blocks a cable each, after a while, you will run out of cables. This is when 'network congestion' happens and new calls don't get connected. In the case of Jio, voice behaves like data, ie, it is transmitted using packet switching. If you remember packet switching from earlier, voice is broken into packets (just like data) and each packet takes its own fastest route to the destination. Packets are distributed evenly across the network routes and there's no concept of a particular route being blocked off for a call between just 2 people. This essentially means Jio can accommodate a significantly higher number of calls on the network. Probably even infinite calls since packets keep getting delivered freeing up space for new packets in a continuous manner. This ensures more efficient utilization of the network for Jio.

Since Jio doesn't run a separate network for voice like others (so...no additional cost) and voice calls generate very few packets to be transferred unlike an HD video or song (so...very low network usage), they can essentially offer voice calls for free. Only 10-15% of Jio's network is used for voice calls, and the rest is used for data. The little bit of network bandwidth that voice calls will use is a tiny price to pay for the kind of marketing buzz they will get for offering free voice calls.

4G was a pretty bold bet Mukesh Ambani took in 2010 when most other telecom operators were busy building 3G. And this bet is paying off pretty well.

BREAK!

This is turning out to be a long piece. So let's take a break.

Ready now? Let's move to the second advantage.

2. The Business Advantage

To appreciate this advantage better, we first need to understand Jio's game plan.

For this purpose, I am going to quickly change Bala's job. Bala wants to start a telecom company now. But to even start providing services, Bala has to set up an entire network of routers, put equipment cell towers, print sim cards, and also pay a huge licensing fee to the government. All this accumulates to at least a few billion dollars in investment. For example, Mukesh Ambani spent $32B (₹2.3 lakh crores) before he could launch Jio. But here's the kicker. Bala cannot charge more than a few hundred rupees ($1-3) a month from subscribers. Simply because they will not pay. Why? Because voice and data services provided by telecom players fall under the bucket of 'utilities'. Utilities are basic, undifferentiated services like electricity. You don't care whom you get electricity from as long as you get something that works. Same with the internet. So price becomes the only point that matters during purchase, meaning the internet provider cannot charge a high price. Of course, all this is assuming there are at least 2-3 players in the market. If there was only one player (monopoly), they can get away with charging a high price for voice and data.

Being a utility hence increases the time it will take to recoup this huge investment Bala has to make. But Bala wants to make a return on his investment as fast as possible. Simply because Bala doesn't know when the next technological innovation will come and he will be forced to upgrade the entire network equipment (costing billions of $ again) to keep up with the new standard (say, 6G or 7G).

Bala is scratching his head. He's thinking about the future already...

"How can I increase what I can earn per person that uses my network? (also called Average Revenue Per User or ARPU). Hmm, well I am providing them a pipe through which they access the internet. I am charging them for using that pipe but there's only so much I can charge them ($1-3, remember?). Oh wait, what if I can provide some service (websites or apps) through this pipe that I own and charge them for those services as well? There are enough companies that have made loads of money by just delivering services through this pipe of mine (eg: Google, Facebook, Spotify). I too can do that. Moreover, I can push my service more since I own the pipe - offer it at a discount to people who already use my pipe or bundle it with my internet plans."

Bala smiles at himself with satisfaction. He calls his friend Lata to narrate how he came up with an excellent plan to solve the 'telecom ARPU problem' only to be told that he isn't a very original thinker. Because almost every telecom company has tried to sell services through the pipe they own to increase ARPU and accelerate their path to profitability. Here's a quick look at what Airtel does in India and what Verizon did in the US.

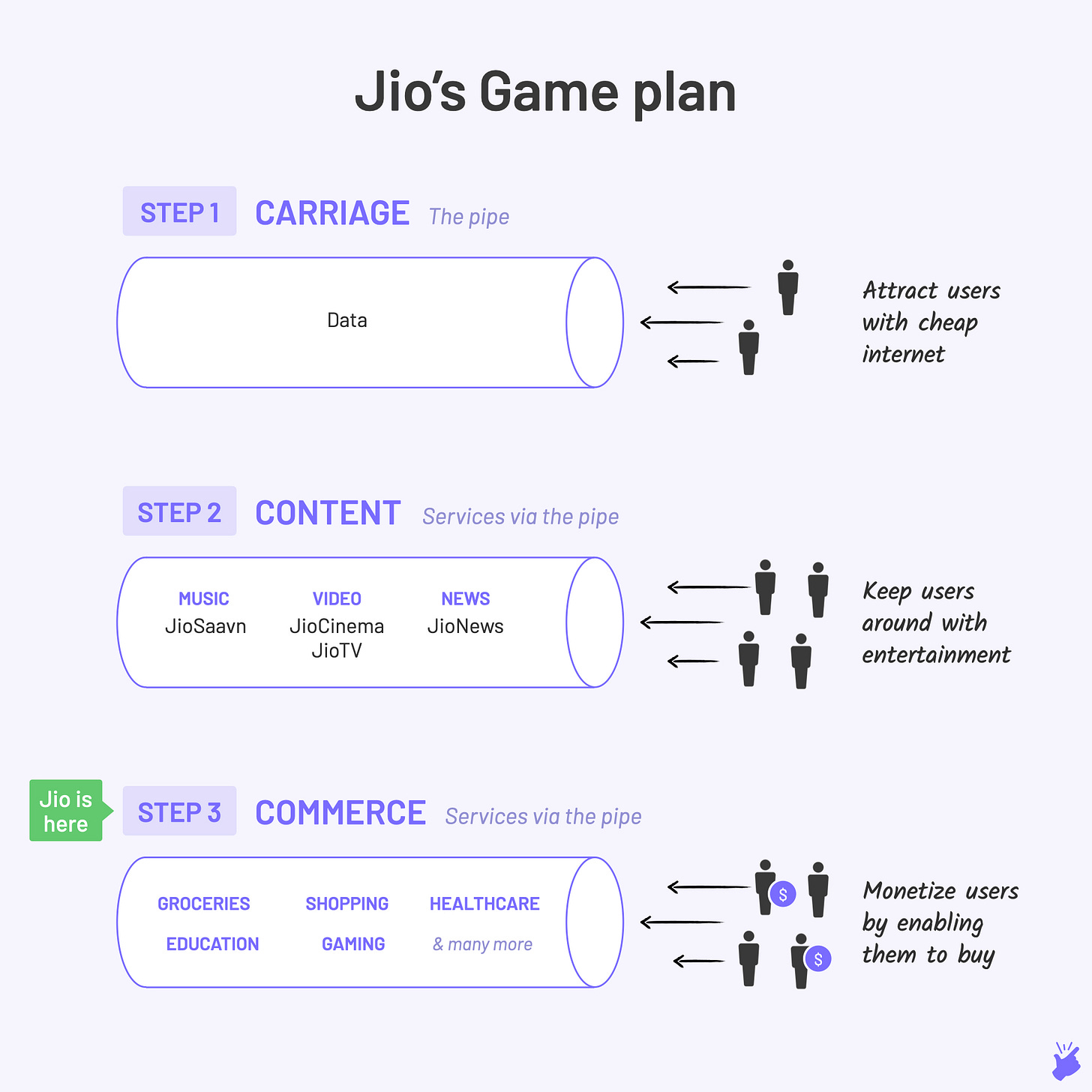

And Jio is no exception. Jio's game plan from the beginning was to attract users with cheap data (cost of <$1/GB vs competitors' average of $3.5/GB); then introduce entertainment apps to keep users hooked - JioSaavn for music, JioCinema for movies and JioNews for news (users needed to spend all that GB somewhere!). And finally, make money off these users by selling them key services - online shopping, education, healthcare, etc. According to Global research firm Sanford Bernstein, Jio is planning to offer up to 10 key services addressing an overall potential market of $2 trillion.

This whole plan of telecom companies selling services via the pipe they own sounds like a great plan. But history has shown that most telecom players have never been successful at expanding beyond their core service. For example, Airtel's Hike has been posting losses for years. Verizon had to shut down their video streaming platform Go90. Airtel's music streaming app Wynk is probably the only outlier, having found a decent amount of traction among users.

So...can Jio be an exception here?

I think yes. But I say yes with a caveat. I don't think Jio will be successful in selling all the services it has planned - many of their apps have already bombed (Eg: JioChat) - but it has a high chance of succeeding at one particular service. And that's online shopping or retail. Luckily for Jio, retail, with a market size of $1.3 trillion, is the largest of all the services Jio has planned.

Why will Jio be successful in retail?

This is where we have to step back and look at the parent company of Jio - Reliance. As per at its latest annual report, Jio accounts for only 9% of Reliance's revenue. Almost 70% of revenue comes from its primary business - petroleum refining and petrochemical products. But it is its second-largest business that I want to bring your attention to - Retail which contributes 21% of Reliance's revenue.

Reliance Retail is a behemoth with 10,000+ stores across 6,700+ cities in India. These stores are broadly split across Reliance Fresh (groceries), Reliance Trends (fashion), and Reliance Digital (electronics & home appliances) - each category humongous by itself. Reliance Retail accounts for a 45% share in India's organized retail & e-commerce. In comparison, Amazon India comes at a distant second with 22% share.

When you change your frame of reference from Jio to Reliance, suddenly, you don't see a telecom operator attempting to do online retail (low chance of success) but an offline retail giant try to go online via its telecom arm (higher chance of success).

It's this retail arm of Reliance that is Jio's advantage. One of the toughest things about doing online retail is to get things to users very quickly. Someone like Amazon actually built warehouses storing products in various locations across the country. So when a user orders a product, the nearest warehouse quickly dispatches the product to the user. For Jio, Reliance Retail's 10,000+ stores, while continuing to operate as shops, will also double up as warehouses. So when Jio launches its online stores, you can expect that latest phone or t-shirt you ordered to reach you as quickly as a day or even lower.

This is an important reason Facebook decided to invest in Jio and not other telecom players (another reason being Facebook can get regulatory approvals quickly with Ambani's help). While Facebook's Whatsapp can be used to place orders (demand), Reliance's huge network of stores will be used to fulfil those orders (supply). In high probability, there is no other telecom company in the world that has a ready retail supply chain & a network of stores (acting as warehouses) to be able to pull off e-commerce. Jio has both. Whatsapp integration is actually a bonus for Jio's retail plans.

However, it is easier said than done. Reliance/Jio will have to figure out how to integrate their offline and online businesses seamlessly. They have the idea and all the ingredients in place. Execution is the only thing remaining, meaning, they can either do a fantastic job or a superbly botched-up job of integrating their online store with their offline network.

Going by the journey of JioMart - Jio's online grocery store (Reliance Fresh in the back end), it seems like Reliance has done a good job of execution. In just 3 months since launch, JioMart has become the country's largest e-grocer with 400K orders delivered a day which is significantly higher than the 280K orders a day delivered by BigBasket, the previous leader.

With JioMart, Jio's business advantage has begun to materialize 🙂

CIAO!!!

If you liked this Simplanation, share it your friends !!

More reads on the topic

From Oil to Jio

A brilliant narration of Reliance's shift from petrochemicals to digital solutions by my new favourite writer - Vedica Kant. Highly recommend.Jio is in the endgame now - The Ken [paywalled]

A nice illustration-filled explanation of Jio's full-stack play by The KenIndia, Jio, and the Four Internets

A Simplanation from me is never complete without a link to Ben Thompson. This is his piece on how Jio is taking India's internet on a different route. This piece sparked my interest in telecom network architecture and today's piece.COAI Annual Report 2019-20

If you are a numbers person, this report by Cellular Operators Association of India (COAI) is binge-material on the Indian telecom industry

Fantastic piece, wrong about Reliance Retail though.

a) Core retail revenues of grocery, lifestyle and electronics are 57% of reported revenues, balance is connectivity (master distributor for Jio in India i.e. not core retail - when you install Jio Gigafiber in your home for example, payment is done to Reliance Retail not Jio) and petro retail.

b) In the Reliance Retail Ltd Annual Report (main entity for retail operations - AR on the RIL website), see the related party transactions between Reliance Retail, Reliance Corporate IT Park Ltd and Reliance Projects and Property Management Services.

(i) They all pay a huge amount of rent to each other. The latter two entities pay rent equivalent to some 40% of retail operations EBITDA. Could be these rents are to do with the Jio Phones operating leases though.

(ii) Most importantly, see the RPTs reported by Reliance Retail Ltd in its AR with these entities and the RPTs reported by these entities in their AR (also available on the RIL website) with Reliance Retail. The two don't add up for some strange reason.

In a nutshell, don't think RIL's retail operations are the reason they will beat Amazon/Walmart - execution usually flows from transparency.

Please share your UPI id. Really want to donate.

What a mind-blowing article. Please do make an app.