#1 How Too-Yumm found its place in a crowded snacks market

A deep-dive into its marketing strategy

Quick Note

Vivek here. Few of you might receive this thinking "Hey, I did not sign up for any Simplanations”. Not to worry. It's a rebrand of my personal newsletter which you signed up for. I have teamed up with my friend Azhar Jafri for Simplanations and today's post is by him. Enjoy!

As per a 2019 Neilsen report, India has a ₹28,000 crore (3.7 billion USD) salted snack market. Pepsi Co's Lays and Kurkure dominate this market followed by a fast-growing ITC's Bingo. Then there are few more players like Haldirams, Yellow Diamond (Pratap Snacks), Parle’s Hippo, Monaco Smartchips, and a dozen other smaller brands.

In such a competitive and densely populated market, RP Sanjeev Goenka (RPSG) Group's brand Too-Yumm, a new entrant, has been a runaway success. How did the 2-year-old brand manage to differentiate its products and create a name for itself?

Viewing Too-Yumm's marketing strategy through 4Ps

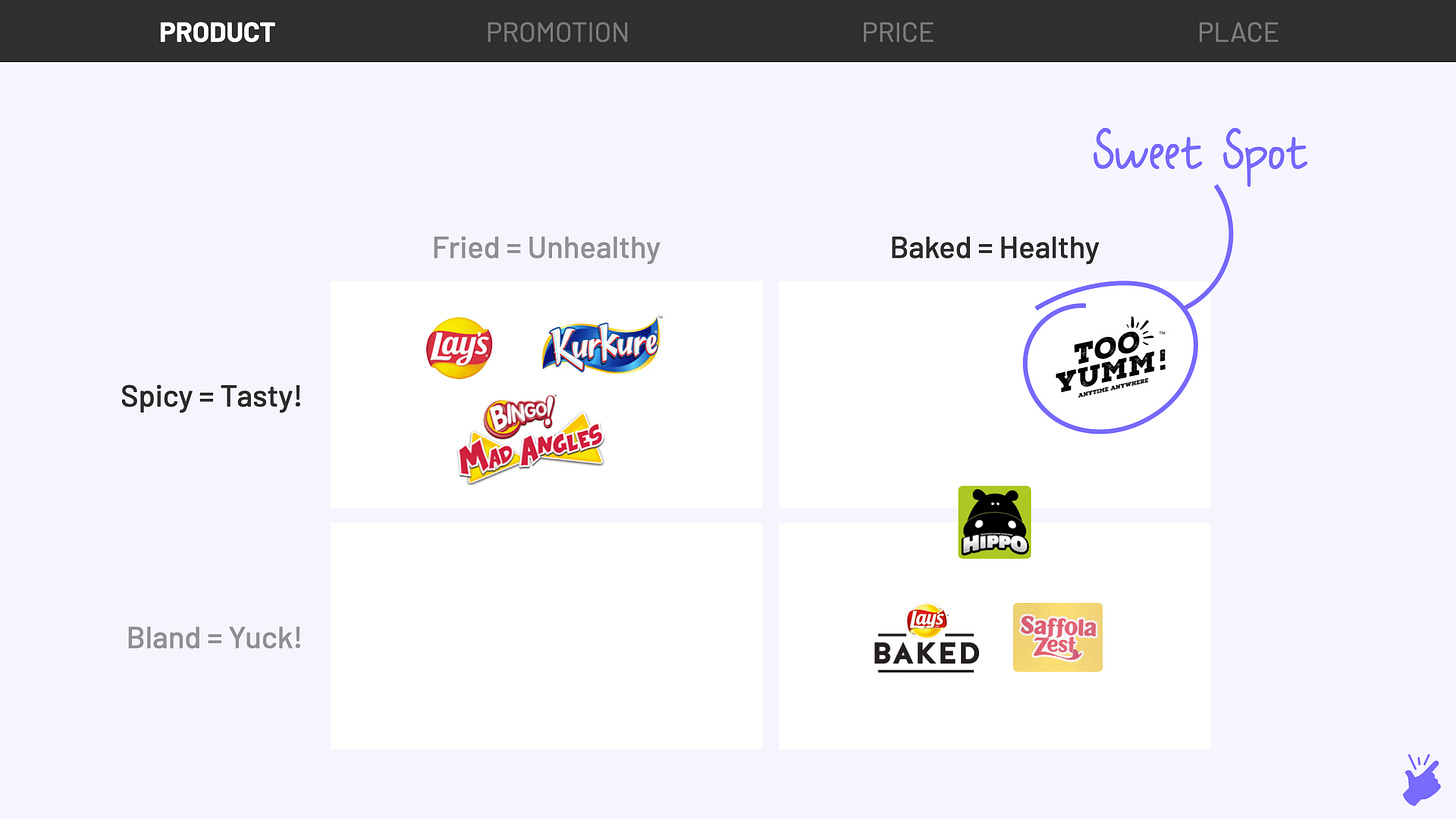

1. PRODUCT: Too-Yumm found the perfect sweet-spot

Given the huge brands that exist in this category, being a me-too brand would not have helped. They needed to try something different in order to make an impact.

While studying the different types of customers, Too-Yumm realized that the young and middle-aged customers (15 to 35 years of age) from larger cities were becoming health-conscious. These folks were trying to avoid fried food (or at least pretending to :P), joining gyms and were worried about their increasing waistline.

Too-Yumm was not the first brand to realize this. Quite a few players had attempted to be the 'healthy snack' for India already and failed.

Saffola Zest: Saffola tried to extend the 'low-cholesterol' image of its oil to create a snack. But it failed to deliver on taste.

Lays Baked: Promoted itself highlighting it had 65% less fat failed as well because of bland taste

Parle Hippo: They managed to create a buzz initially, with stores running out of stock. But demand fizzled out with time as the taste was not good enough like regular snacks

The above three brand stories would have been very helpful for Too Yumm to decide on the 'product attributes' - the points on which a customer compares products. And one attribute was very clear to Too-Yumm: Taste. Taste was something that could not be compromised. Too-Yumm's insight was to create a healthy snack that tasted as close to the traditional snack as possible.

Based on this insight, Too-Yumm created products that balanced taste and health like "Tandoori Foxnuts" and " Desi Tadka Wheat Thins". These variants were baked instead of fried (a healthier option) and at the same time spicy/salty instead of bland (a tastier option).

2. PROMOTION: A relevant & popular face for the product

After having finalized the product, it was essential to communicate the combined health and taste benefit of the product to consumers. Also, being a new brand, they needed a face whom the Indian consumers can connect to. Too-Yumm roped in Virat Kohli for the promotion. It is said that he himself tried the product for 2 months before coming on board. Having Virat, a fitness icon resonated well with the health image of the snack. The product even had his image on the packaging for improving recall.

Advertisement efforts were heavily focussed on TV to create mass awareness. The TV ads were funny and right on point. One of the ads even shows how Too-Yumm is exactly similar to a normal fried snack but is also healthier at the same time (see pic below).

Too-Yumm also promoted the brand in digital channels through a collaboration with Amazon Prime Video. The snack was shown as the sponsor of the Cricket Power Play league in the show 'Inside Edge'. The idea was to promote Too-Yumm as the healthy snacking option while binge-watching.

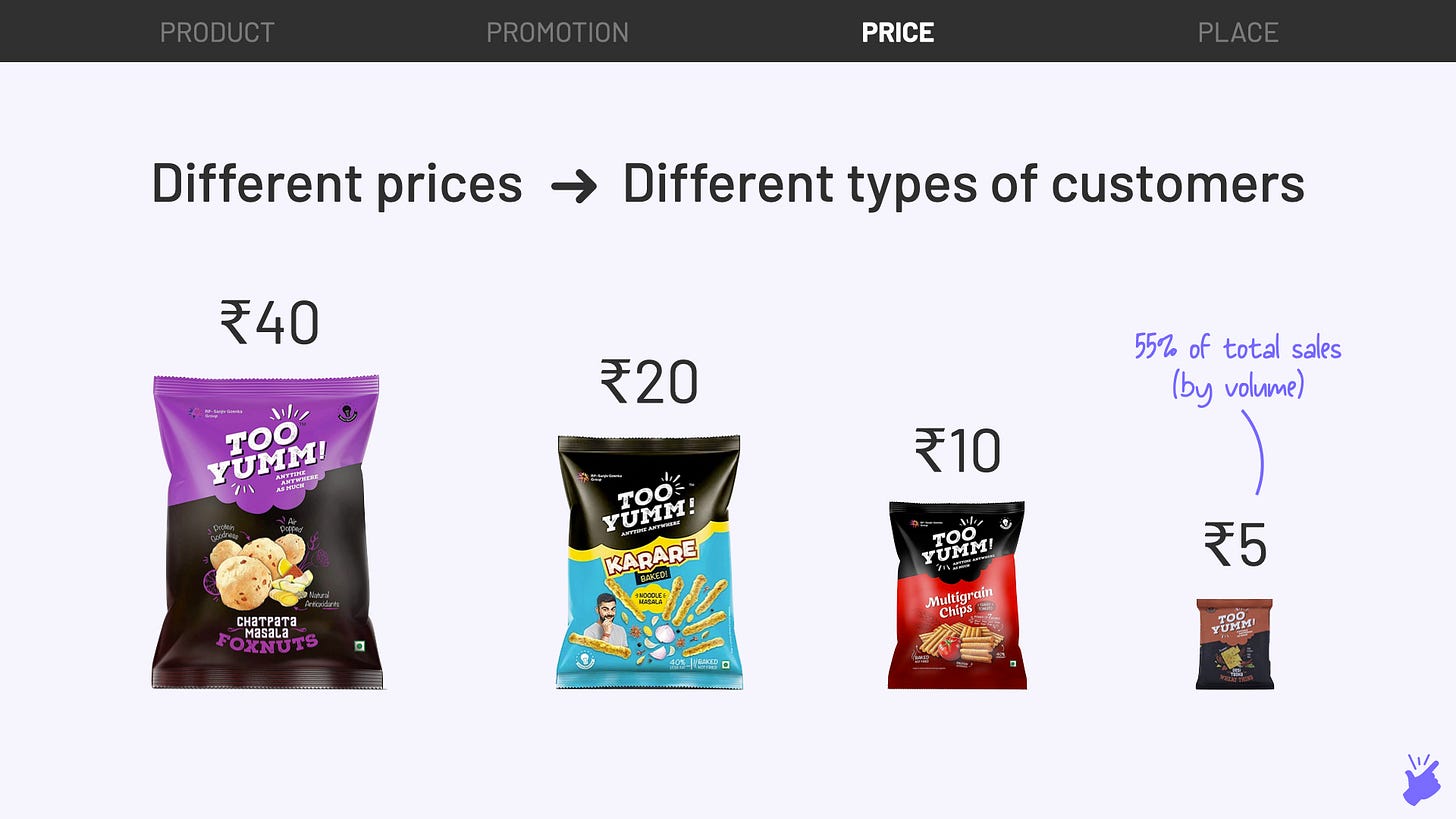

3. PRICE: Affordable for many

Initially, Too-Yumm was launched in larger pack sizes with prices between ₹20-40 (0.3 to 0.6 $). But they soon realized they needed to have smaller packs with lower prices to be accessible to a larger number of customers. That's when they launched the ₹10 (0.12 $) and ₹5 (0.06 $) packets. And it worked. The ₹5 pack now comprises 55% of their total sales (by volume) in the snacking category. ₹5-10 (0.06 $ to 0.12 $) packs also put Too-Yumm in the same price range as that of their competitors.

With a larger variety in pack sizes and price points, Too-Yumm is able to cater to customers from different economic segments.

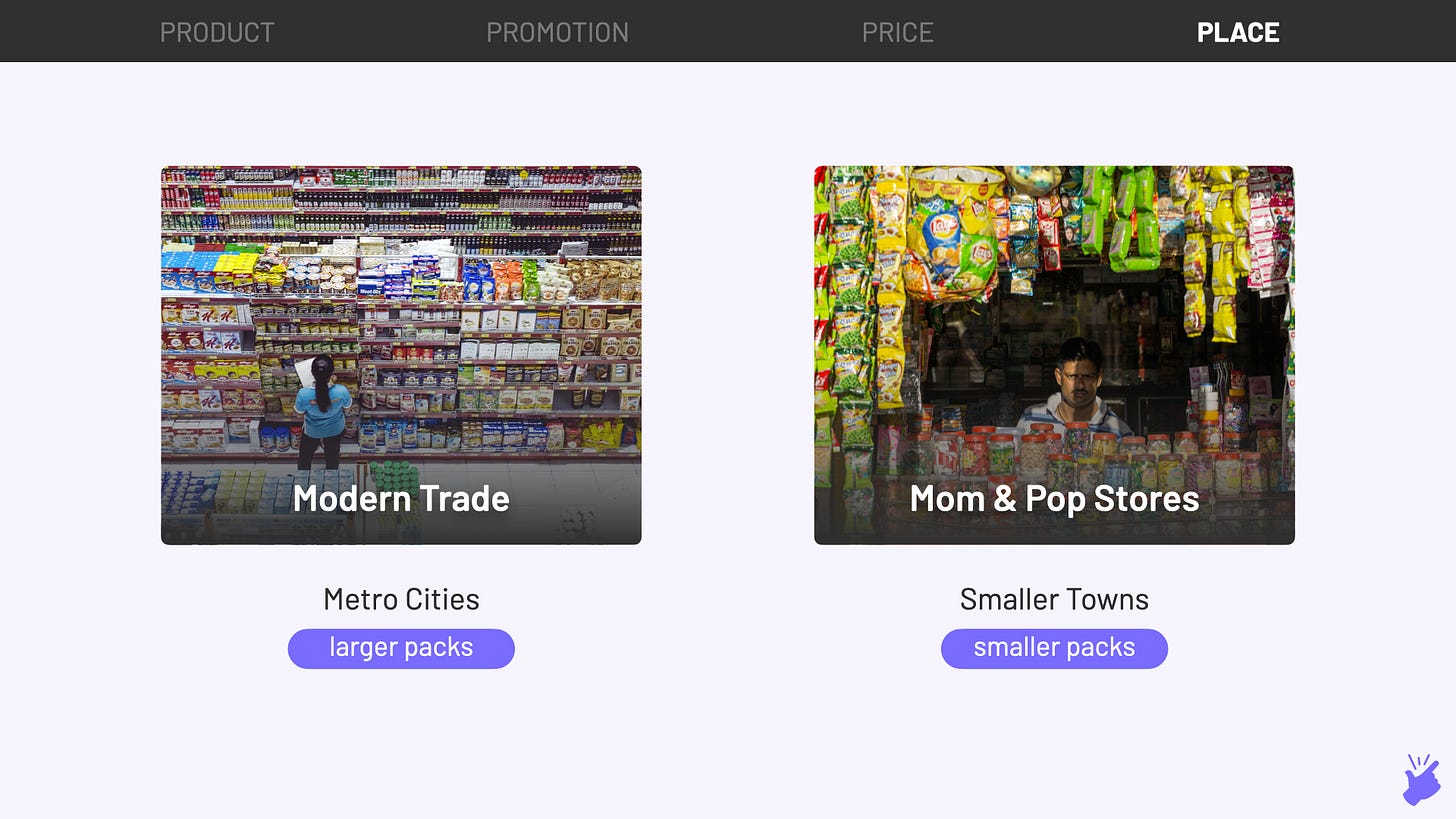

4. PLACE: Large packs, Large stores. Small packs, Small stores.

Too-Yumm first started selling in metro cities (Tier 1) at 'modern trade outlets' (the large supermarket chains like D-mart, Spencers, and Star Bazaar) and e-commerce sites (Amazon). With the higher price point at the beginning, these were the right places to target the urban health-conscious customer with higher spending power.

After the introduction of smaller packs, Too-Yumm expanded to smaller towns (Tier 2) by making themselves available at neighbourhood kirana stores ('mom & pop stores'). In the future, they plan to expand to even smaller towns (Tier 3).

They are also present in international markets - Dubai, Singapore, Nepal and Oman which have a significantly large Indian origin customer base and similar tastes. In total, they are present in around 3 lakh outlets.

On track to be a ₹600cr brand by the end of this year

For a relatively unknown brand in an intensely competitive market, Too-Yumm has come a long way. Started with a simple insight that consumers don't consider tasty as healthy, they created a good product, chose the right brand ambassador, learned their lesson in pricing and ensured extensive distribution of their product.

Too-Yumm kicked-off with sales of ₹50 lakhs (70K $)/month (🤯) and reached ₹5 crore (700K $) mark in just 3 months after their first ad campaign. At present, they are on track to clock sales of ₹600 crores (80 million $) in 2020. By 2025, they intend to become a ₹10,000 crore (750 million $) brand.

This post turned out to be a little longer than a snack. But we hope you found it useful. Do let us know your thoughts by replying to this email.

If you liked this Simplanation, share it your friends !!

It is written that "they started with an insight that customers don't consider tasty as healthy". So, that means they feel only health conscious people buy their product? In that case, how many people beyond tier - I cities are health conscious? I would like to draw an analogy of coca-cola's failure of "diet coke" in semi -urban and rural areas. Because, the notion of health consciousness is secondary when compared to taste. It will be interesting to see how they are going to perform in tier - II & III markets.

Hippo was discontinued in 2014. How is the 2019 Nielsen report showing its market share? It raises questions on authenticity of all your data. Also, your analysis of Hippo is incorrect. Demand did not fizzle. It remained very popular till the end. A quick google search will show you that its flavors had an entirely positive response. Too Yumm has adapted many of them.